|

| Click Here to Download PDF |

Accounting for Antique Dealers

When you visit our offices at Sladen House in Newtown you'll appreciate our passion for history and the craftsmanship behind pieces of art and furniture whose design have withstood the test of time.

Antique dealerships are truly fascinating businesses and our clients specialise in a range of antiques including jewellery, furniture, paintings, clocks and books. Their stock presents in a range of conditions from mint to dilapidated and they often come from different eras. In the furniture sector alone, items can be made of different timbers such as rosewood, oak, mahogany and walnut.

Running an antique dealership presents many challenges and while television shows like Bargain Hunt and Antiques Roadshow have raised the profile of antique dealers, these shows typically feed on the extraordinary stories that make it look easy. The truth is, spectacular valuable finds do happen but the majority of antique transactions involve picking items and then selling them at a modest profit. It’s not easy and you need to provide customers and collectors with an interesting collection plus you need to do your homework and research. You also need to back your judgement and be able to distinguish between a valuable antique and a fake or knock off.

Sourcing new stock can mean getting up at the crack of dawn and driving long distances to attend fairs and markets. It’s not glamorous but in antiques, the early bird often catches the ‘worm’. Successful antique dealers need to have strong negotiation skills to deal with the public including collectors and trustees of deceased estates. It doesn’t matter whether you sell furniture, pottery, memorabilia or Chinese porcelain by auction or private sale, you need to build a great customer database. In fact, your marketing could be the difference between gloom, doom and boom.

STARTING AN ANTIQUE DEALER SHOP

Antique dealers are one of our specialist client groups and having mentored hundreds of business owners through the start-up phase of their business we have built a reputation as business start-up specialists.

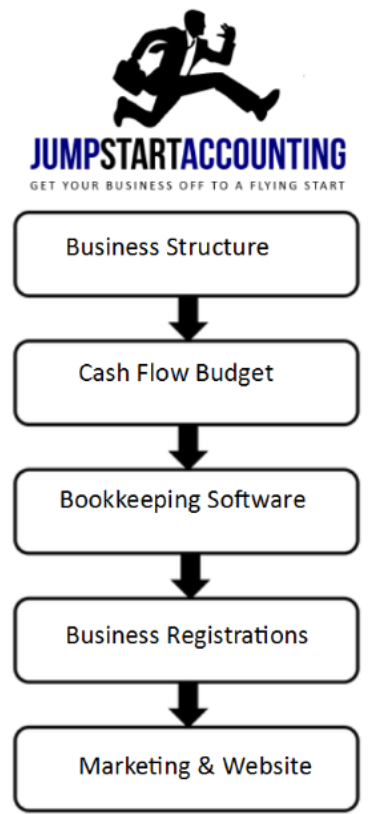

If you are looking to start an antique shop or buy into an existing operation, there are numerous issues to consider. You need to establish

your business and tax structure, complete tax and GST registrations, consider insurances, select an accounting software program and possibly

explore your finance options. It can be a maze and haze of issues but as accountants and business advisors we can assist you in all of

these areas plus provide advice on the preparation of a business plan, marketing plan and a cash flow budget. If you are contemplating

employing staff we can also assist you with human resource matters including payroll, WorkCover and your superannuation guarantee

obligations.

Over the years our team of accountants have helped a number of antique dealers get their business off to a flying start. We offer you experience, technical tax knowledge and most importantly, an intimate understanding of your industry.

Starting a business is a bit like building a house. It requires solid foundations and in a business sense, these foundations include the right tax structure and accounting software, adequate and appropriate insurances together with a marketing plan and a lead generation website. Your choice of business structure is absolutely critical and there are a number of different options including sole trader, partnership, company and trust. When selecting the most appropriate structure for your business we always recommend you ‘start with the end in mind’ because Australian tax laws are complex and changing your business structure at some point in the future can trigger a capital gains tax event that could prove very costly.

Whenever we provide advice on business structures we always take into account:

- Income tax minimisation

- Maximise asset protection

- Allow for the admission of new business partners or investors

- Comply with all legal requirements in your industry

- The risk profile of your industry

- Consider future entitlement to discount Capital Gains Tax Concessions

As a consequence, we often find the business structure for antique dealer clients is a compromise based on the relative importance of each of these issues.

Choice of Accounting Software

Another

brick in your business foundations is your choice of accounting software. Poor record keeping is one of the biggest causes of business

failure in this country and up to date, accurate financial records let you make informed business decisions. The wrong choice of software

can be catastrophic for an antique dealer and all too often we find business owners produce what we describe as ‘computerised shoebox’

records that cause frustration, waste time and create additional fees. This conflicts with our mission of helping you cut the time and cost

associated with bookkeeping.

Another

brick in your business foundations is your choice of accounting software. Poor record keeping is one of the biggest causes of business

failure in this country and up to date, accurate financial records let you make informed business decisions. The wrong choice of software

can be catastrophic for an antique dealer and all too often we find business owners produce what we describe as ‘computerised shoebox’

records that cause frustration, waste time and create additional fees. This conflicts with our mission of helping you cut the time and cost

associated with bookkeeping.

When selecting the most appropriate accounting software for your business we always recommend you match your business needs with your level of accounting skill. You’ll find we support a range of different software options but we do have a preference for cloud based solutions like MYOB, QuickBooks and Xero because of their flexibility and the fact that you can access your financial data via the internet and invite your accountant or bookkeeper to view your accounts at the same time. This means you can get bookkeeping support and valuable advice in real-time. You can also log-in anytime, anywhere on your Mac, PC, tablet or smart phone to get a real-time view of your cash flow. Your data is automatically backed up and users have access to the latest version of your financial data plus you never need to worry about installing software or program updates.

Tools, Checklists and Plans

For

antique dealers starting up their business we have developed a number of tools including a start-up

expense checklist

broken down into various categories including:

For

antique dealers starting up their business we have developed a number of tools including a start-up

expense checklist

broken down into various categories including:

- tools and equipment

- professional advice and software

- information technology costs – software and hardware

- marketing and signage

- vehicle costs

This checklist will help you identify all your potential establishment costs and these figures then feed through to our cash flow budget

template and allow us to produce a projected profit and loss statement for your first year of trading. These reports can also tuck neatly

into our business plan template that is designed to help you secure funding from external sources like a bank. Another useful tool is our

business start-up checklist that walks

you through key business registrations you might require, insurance options, legal issues, branding and domain name registrations for your

website

In summary, if you're contemplating starting a business you don't need to reinvent the wheel as we have all the tools and resources to help you get off to a flying start. In fact, that’s just the beginning because as accountants we can do some financial modelling and prepare some ‘what if’ calculations based on different price points so you know your business’ best and worst case profit scenarios.

MARKETING YOUR ANTIQUES BUSINESS

Accountants also operate in a very crowded market and recognise the importance of marketing. While we have a small firm personality, we have big firm capabilities. One feature that distinguishes us from other Geelong accounting firms is our marketing expertise.

Online shopping has squeezed retailers' margins with an army of consumers armed with smart phones instantly comparing prices on virtually every commodity offered for sale. Antique retailers still have to compete online but antique dealers have considerably more control over their product costs and selling prices than your average retailer.

Antique retailers rely on their range, knowledge, reputation, location and referrals to grow their business. While these ingredients certainly remain important, in the digital and social age you need to shift your marketing focus online. Increasingly local searches like ‘antiques Newtown’ are driving traffic to your website which is often the first touch point with a potential new customer. As you know, in business, you only get one chance to make a good first impression and your website is your 'online shopfront' and silent sales person working 24/7 to promote your antique business.

Over the past few years we have worked with dozens of clients to help them create quality, affordable lead generation websites that are responsive to smart phones and tablets. We can help you plan and build your website, optimise it for Google and the other search engines plus assist you with your content creation including video production and digital publishing. If your website is missing features like lead magnets, calls to action or landing pages we'll help you build them plus we'll also introduce you to strategies like re-marketing and search engine optimisation to drive more traffic to your website.

Your brand should resonate with your target market and we can assist you with the development of your business name, logo and slogan and

corporate brochure plus help you write blogs and newsletters. In addition, we can help you harness the power of social media to win more

referrals. If you aren’t using some of these marketing techniques your business probably won't reach its full profit potential.

We will help you understand the four ways to grow a business plus identify the key

profit drivers in your business. We can walk you through a number of profit improvement strategies and even quantify the profit improvement

potential in your business. Our role is to make sure you know your numbers and don't leave any profit or tax savings on the table.

If you're an ambitious business owner looking to fast track your business success, the team at Scotts Chartered Accountants offer you a range of accounting, taxation, marketing and business coaching services including:

-

Start-Up Business advice for antique dealers and retailers

- Advice regarding the Purchase or Sale of your Antiques Business

- Tools including the Start-Up Expense Checklist and Templates for a Business Plan, Cash Flow Budget, Letterhead and Business Card

- Advice and Assistance with the Establishment of Your Business Structure - Company, Trust, Partnership or Sole Trader

- Tax Registrations including ABN, TFN, GST, WorkCover etc.

- Preparation of Business Plans, Cash Flow Budgets and Profit Projections

- Accounting Software Selection and Training – Bookkeeping, Invoicing, Quotes & Payroll

- Preparation and Analysis of Financial Statements

- Preparation of Finance Applications - Loans to Buy a Business, Expand, Franchise Fees

- Bookkeeping and Payroll Services - MYOB, Cashflow Manager, Xero, Reckon & Others

- Tax Planning Strategies

- Assistance with your Marketing including your Branding, Corporate Brochure etc.

- Advice and Assistance with your Website Development - Content, Videos, Blog Posts and SEO

- Wealth Creation Strategies and Wealth & Retirement Planning Services including Transition to Retirement & SMSF's

- Industry Benchmarking and Management of Key Performance Indicators (KPI's)

- Vehicle & Equipment Finance (Chattel Mortgage & Lease)

- Advice & Assistance with Pricing your Services and Claiming Motor Vehicle Expenses

- Recession Survival Strategies

- Advice regarding Employee Relations and Workplace Laws

- Business & Risk Insurances (Income Protection, Life Insurance etc.)

- Business Succession Planning

In

summary, we are not just tax accountants. We are business and profit builders who strive to deliver practical, cost effective advice that

could give you a serious competitive edge in your industry. Our marketing skills distinguish us from other Geelong accounting firms and

antique dealers have become a niche area within our firm.

In

summary, we are not just tax accountants. We are business and profit builders who strive to deliver practical, cost effective advice that

could give you a serious competitive edge in your industry. Our marketing skills distinguish us from other Geelong accounting firms and

antique dealers have become a niche area within our firm.

If you're a committed and ambitious antique dealer looking to accelerate your success we invite you to book a FREE, one hour introductory consultation to discuss your business. You can expect an hour of practical business, tax, marketing and financial advice that could make your business more profitable, valuable and saleable. To book a time, contact us today.

Scotts Chartered Accountants - Infinite Possibilities